Are you wondering how much flood insurance costs? If so, you should read our guide to average prices here.

The United States had 5,178,978 flood policy Most of these guidelines are common in flood-prone countries. The flood insurance rates depend primarily on the flood risk, the coverage you need and the structure of your house.

Unfortunately, many homeowners who should have flood insurance have not bought one. The main obstacle is high costs, especially in flood-prone areas. It is important to note that the price of non-insurance is often higher than that of investing in flood insurance.

Are you wondering how much flood insurance costs? You are in the right place. In this manual you will find the average prices.

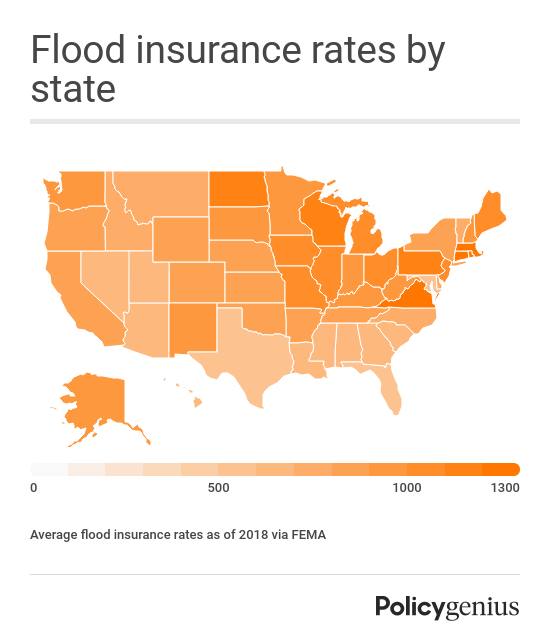

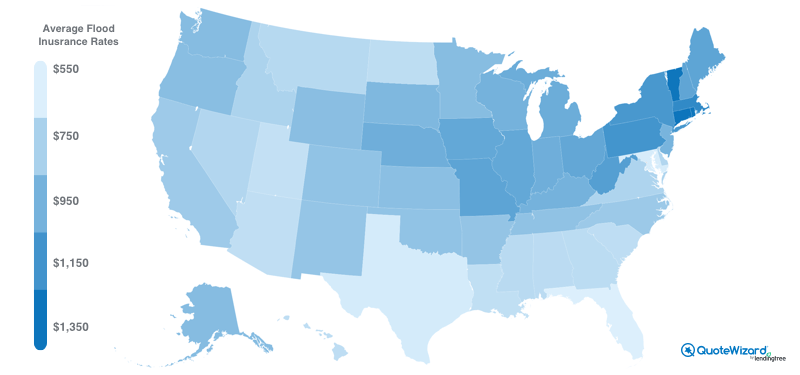

How much does flood insurance cost from the state?

National Flood Insurance Program (NFIP) coverage averaged $ 642 per year in 2018. Flood insurance costs vary from state to state. However, the flood zone level, the house structure and the type of cover are the central determinants of the flood insurance costs.

It is important to note that the maximum coverage under the NFIP guidelines is $ 250,000 for a house, while $ 100,000 applies to the items in your house. While some people opt for private cover, NFIP is arguably the most popular flood insurance program in the United States

When presenting government flood rates, it is important to categorize the most expensive and the cheapest. Note that these estimates can change due to a number of factors, including: B. in low risk areas. Use a flood insurance cost calculator to better estimate your state’s tariffs.

States with high-price flood insurance

The most expensive countries for NFIP flood insurance are Vermont, Connecticut, Pennsylvania, Massachusetts and Rhode Island. Insurance costs for these countries are $ 1,391.24, $ 1,394.83, $ 1,175.58, $ 1,251 and $ 1,389.22, respectively.

For states like Rhode Island, Massachusetts and Connecticut, the high cost of flood insurance is not surprising. These states are relatively small and are located in coastal areas, making most homes prone to flooding compared to other states.

Conversely, landlocked states like Pennsylvania and Vermont are still part of the states with high insurance rates, although they appear to be less prone to flooding. Given that the sample size is smaller in these two countries, the average cost can be high. However, if you live in these states, you may be paying a relatively lower rate than stated.

States with inexpensive flood insurance

States like Florida, Texas, Maryland, Louisiana and Utah have lower flood insurance rates. Average insurance costs for these countries are $ 550.33, $ 581.11, $ 572.91, $ 664.43 and $ 653.78 respectively. If you know about the flooding rates in Texas and Florida, these low rates seem surprising.

As expected, houses in less flood-prone areas have cheap premiums for flood insurance. The low average for these rates results from the significantly low risk. In Texas and Florida, the risk is somehow distributed, making the average cost of flood insurance in those states cheaper, regardless of the flood plains.

Although your home is in an area where the risk is low, you should invest in a flood policy. You can think about it Better flood insurance for the best coverage at friendly prices. You never know when a hurricane will strike!

Influence of flood zones on insurance costs

If you are wondering how much flood insurance costs depending on flood risk, you need to know more about the three flood zones. The flood zones A, B and C determine the price you pay for your insurance.

Zone A refers to high-risk areas. These zones have a 25% probability of flooding over a period of 30 years. You also have a 1% flood risk per year.

Canarsie is one of the neighborhoods in New York City where the average cost of flood insurance could rise $ 600 to at least $ 3,000 by 2022. The region is a high risk area. Flood insurance premiums could also be mandatory for everyone in the neighborhood.

Zone B refers to medium to low risk regions where flooding is less likely. Your mortgage lender may not require flood insurance. In this zone, you can get the NFIP Preferred Risk Policy, which allows you to get a policy for just $ 200.

The indefinite flood zone is commonly referred to as Zone C. Flooding is unlikely in these regions. However, this does not mean that flooding is impossible and it is advisable to invest in flood insurance.

Flood insurance in undetermined areas can be expensive due to the underlying uncertainty. You may want to compare offers from different insurers to find out which premiums are included in your budget.

How you can reduce the cost of flood insurance

You can break a bank in flood insurance, especially if you live in high-risk regions. Moving is one of the best ways to cover the high cost of flood insurance. However, this option is not always durable for homeowners.

You can review your eligibility for the Preferred Risk Policy, which provides coverage at a lower cost. This standard flood insurance applies to houses in Zones B and C in NFIP communities. The maximum coverage in this situation is $ 250,000.

It would also be advisable to review the Community Rating System. You can get this discount based on your community’s efforts to mitigate flooding. With the discount, you pay significantly lower premiums.

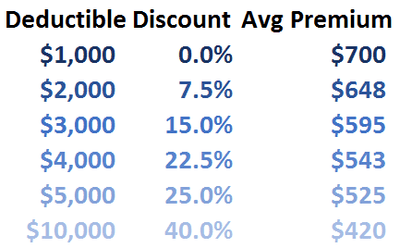

You can further increase your deductible to reduce your flood insurance costs. With a high deductible, your premium is low, which also affects your damage payment. Therefore, you may need to make some withdrawals in the event of a disaster.

Are you wondering how much flood insurance costs? You’re not alone

Most homeowners think about flood insurance rates. You should understand that your standard policy does not cover flood damage. You need flood-specific coverage, especially if you live in a flood-prone area.

How much does flood insurance cost? Well, it mainly depends on your condition. Flood zone states have expensive insurance policies. It is advisable to get quotes from various flood insurers to find out the premiums in your budget.

Please visit our website for more content at home.

TopsDecor.com Home Decor Ideas

TopsDecor.com Home Decor Ideas