Preparing to buy a house is one of the most exciting times in your life. It is also one of the most confusing and stressful times in your life. There is so much you need to know and you have to learn everything quickly! If you don’t, you could make costly mistakes that could affect your life and finances for a long time.

Still overwhelmed? Of course you are! But do not worry. We’re here to give you insider tips on how to become a homeowner who makes the whole process less intimidating.

- Know your budget … and be realistic!

The biggest mistake that many first-time buyers make is not understand their budget.

Look at all of the costs

Sit down and crack all the numbers. List all your expenses, all your debts and compare them with your income. Once you’ve looked at your budget, you should be realistic about what you can afford.

Remember that paying your home is much more than just paying the mortgage. Depending on your neighborhood and the type of house you buy, taxes, homeowner insurance, and possibly club fees may apply. Make sure you take these costs into account when figuring out how much house you can afford.

The 28/36 rule is a good benchmark. The monthly cost of your house should not exceed 28% of your monthly income. And your housing costs shouldn’t be more than 36% of your total debt.

You also need to consider money for the down payment, closing costs, and any repairs that result from inspections that the seller doesn’t want to do.

Shopping within your budget

For most people, once the numbers are on paper, they find that they cannot afford nearly as much as they thought. This can be really disappointing, but it’s better to know.

Do yourself a favor and don’t even look at houses before diving deep into your budget. Even if you think you have a good idea of your finances, look at everything again before you scroll through Zillow for hours. If you don’t, you will be looking at houses outside your price range and will be very disappointed. Or worse, you’ll see to yourself that you can afford this dream home when you really can’t.

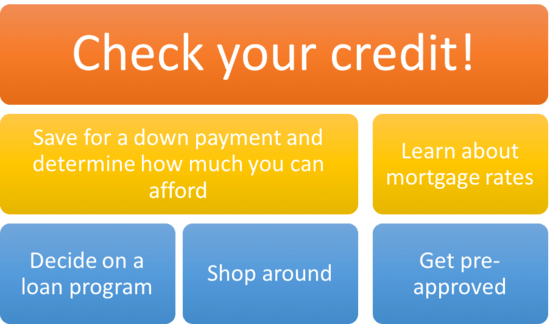

- Get pre-approved for a mortgage

Knowing how much house you can afford is not the same as knowing You can be approved for a mortgage. Even if your finances are in good shape, you could face problems getting a mortgage. You may not be able to get approved for as much as you expected, which limits the number of homes you can afford.

Once you’ve looked at your budget, it’s time for it be pre-approved for a mortgage. Pre-approval is the best kind knowing which houses are in your price range because you know for sure that you can get a mortgage for that amount.

Before speaking to lenders, it is a good idea to understand your creditworthiness, debt to income ratio, and put all of your financial information into one accessible file. The pre-approval decision is made based on these factors. So if you are comfortable with all of this information, you will be better prepared for the process.

One mistake many first-time buyers make when pre-approved is to only speak to one or two lenders. To get the best mortgage approval, you should speak to as many lenders as possible. It’s very tiring, but it’s worth making sure you get the best deal possible.

Remember that pre-approval is not a guarantee. More information will help you when buying a home.

- Know what’s important to you

Now that you are on your budget and have pre-approved a mortgage, it’s finally time to start looking for a home!

While browsing all of these entries, it is important to make it clear what you and your family want and need from your new home. Functional things like the number of bedrooms and bathrooms, the size of the yard and the additional costs are certainly important.

But there is much more to consider. What is the neighborhood like? How good are the schools? What are property taxes and are they likely to increase? What is there to do in town?

Many people fall in love with a home without paying enough attention to the city, neighborhood, or public services. They end up in their dream home, but in an area they don’t like.

So keep in mind that it’s not just about the house, it’s about building a new life in a new place.

- Become an experienced negotiator … or hire one

Buy a house involves so much negotiation. Most houses don’t sell at their price. You make an offer, the seller makes a counter offer, you counter this offer. And you will be competing with whatever other offers they get!

Many houses need work before they can be sold due to the inspection. Negotiating who pays for this work and how it affects the house’s selling price can be an incredibly stressful process.

If you do the buying process yourself, you need to be an experienced negotiator. It is a much better idea Working with a broker Who will handle these negotiations for you for a fee.

- Be ready to leave

The hardest part of the buying process is getting ready Not buy the house.

Often people fall in love with a house and their emotions take over the buying process. This is a simple ticket to the danger zone. If your feelings determine the home buying process, you’re guaranteed to make a mistake. You may be convinced to buy outside of your price range, to pay for repairs you shouldn’t be paying for, or to pay well above the price.

If the negotiations don’t go your way, if the utility costs go up, if you can’t beat another offer, you have to be ready not to buy that particular house. You have to be ready to walk away from any home, even your dream home.

The right house for you will come. If so, thank you for leaving.

More advice on how to become a homeowner

These tips are just the basics of how to become a homeowner for the first time. There is so much to consider when buying your first home that we cannot possibly include everything in a blog post.

So if you’re looking for more information about buying your first home, check out the posts tagged “Home”.

TopsDecor.com Home Decor Ideas

TopsDecor.com Home Decor Ideas