Buying your first home is a big deal. In theory, you will live there for 30 years or more, celebrate many life milestones there and possibly even pass them on to future generations. However, if you’re a typical first-time buyer, you’re likely working with a number of budget, location, and equipment restrictions. As house prices rise, rise, and rise, you may be wondering if home ownership is possible for you at all.

Fortunately, knowing what to look for and how to get out of the typical shape of the first buyer can help you end up in your dream home, even if you only plan to stay there for a few years. Here are some key considerations and facts to consider when searching the market for your first home.

- The profile of the first time buyer changes

Tipping: Think outside the box. Smart, modern buyers tend to be unconventional, like mobile homes and tiny housesto help tackle the real estate crisis among 35 year olds.

Gone are the days when the starter home belonged exclusively to the young, white couple. Today women, millennials and Hispanics are the ones fastest growing demographic in the real estate marketand they’re not particularly keen on the status quo. With a completely new buyer profile, new buyer preferences and expectations come, and we are beginning to see these new buyers moving to unconventional options.

From Devour mobile homes for sale In desirable areas to redefine which population may live in condominiums, there is no reason to limit yourself to the “traditional” image of a new homeowner or to stick to the typical homeowner’s home. Thanks to their affordable, eco-friendly appeal Prefabricated homes have proven to be a popular option with young buyersand they shouldn’t be overlooked for those just getting started.

- Owning a home is more than just your mortgage

Tipping: Avoid using these seemingly practical mortgage calculators on real estate websites. she can be misleading because they often leave out important information, especially property taxes.

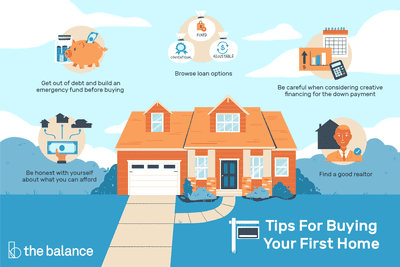

We believe it is important to note that many young real estate agents do not know that as a home owner, there is a lot more to pay, maintain and monitor than a tenant. The fact is that home ownership is expensive and unpredictable, so it is much more difficult to make an accurate forecast than rent.

When thinking about buying a home, it is important that you get an accurate cost estimate that takes into account current property taxes and any necessary property upgrades. Remember to search your utilities for a quote on monthly gas, electricity, and water payments. Talking to neighbors can help. Don’t forget to consider the homeowner’s club fees, if any.

What you have to pay for::

- mortgage

- Mortgage rates

- Property taxes

- Private mortgage insurance *

- maintenance

- Utilities

- Facility

- Lawn care

- Repair

Private mortgage insurance (PMI) does not apply to all properties. However, this is often required by buyers financing a home with less than 20 percent equity, including many first-time home owners.

- Everything is negotiable, especially in certain markets

Tipping: Be aware of all of the above costs when negotiating your first home. If you find high costs that you need to consider when moving in for the first time, e.g. For example, aesthetic improvements or repairs, you may be able to persuade the seller to compensate for some of them.

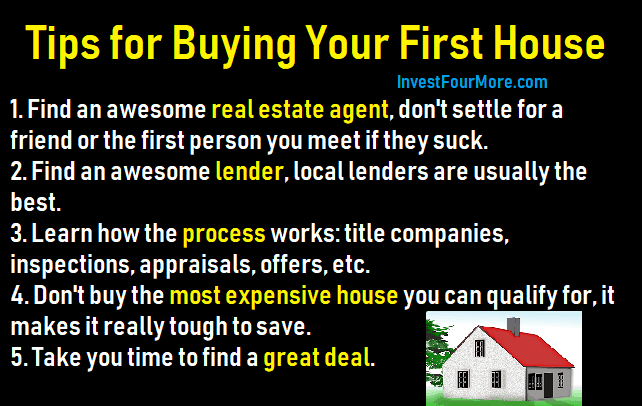

Unfortunately, most of us don’t learn how to bargain at school, which means we often remain completely in the dark about how to get a reasonable deal when shopping for our first home. Working with a good real estate agent who knows the market inside out is your best approach here. Make sure you work with someone you trust and who knows the peculiarities of the area.

One of the smartest ways to get the best price on your first home is to do things on a very strict budget and with an open mind. It is also helpful if you are shopping at a time of the year that is traditionally not “hot” in real estate, e.g. B. during the holidays or at the beginning of the year. You are less likely to steal the business when the market is particularly active, which is the case in most regions during spring and summer.

- It may be worth thinking outside of the standard list

Tipping: Although the vast majority of homes are sold through traditional channels such as real estate agents and online offering websites, there are some other ways to find homes for sale that the rest of the buyer pool may not have considered.

As convenient as it is to browse online real estate websites all day long until you find your dream home, it can be worth taking the less busy real estate road, especially if you live in an area with a particularly limited market. Finally, the rest of the buyer pool – which may include cutthroat competitors in some areas – is likely looking at the same offers as you, which drives up the price.

A good option is Buying a foreclosed house when selling a sheriff. Although this option is primarily intended for handy types and those who have cash, it can lead to big savings. Typically, these auctions or sales take place when the property owner cannot make the payment and the lender tries to sell it to recover some of the money. It is therefore possible to get cheap offers for these offers.

Home ownership is still a generally safe step

Owning a home is still considered a fairly safe investment, but the benefits go far beyond financial. As a homeowner, you have complete control over your space – how it’s decorated, who comes by when, and more – and it will be worth it in the end. Just think about it before you go in and you will surely find the perfect home to call yourself!

TopsDecor.com Home Decor Ideas

TopsDecor.com Home Decor Ideas